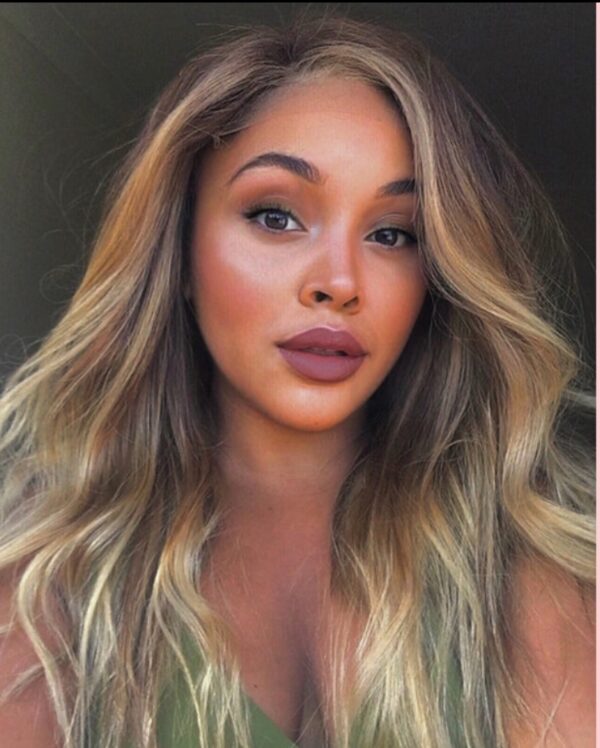

VAT Relief for UK Residents

You can claim the VAT back on your wig purchase (currently at 20%) if you have Alopecia, are receiving chemotherapy, are chronically ill or have any other disabling condition and you are a resident of the United Kingdom. VAT relief can be applied on multiple wig purchases. For eg, if you brought 2 wigs, you can claim the vat for both, and would need to send fill out and send back two forms. You need to fill out the form and send back within 7 days of making your wig purchase (s).

VAT exception is ONLY available for residents of the United Kingdom. It is illegal to make a false claim, so please be mindful of this when filling out the form and claiming the VAT relief.

If you have any questions you can get advice on the HMRC website or by phone at 0300 123 1073 or speak to your GP.